X

As of January 1, 2025, the State of Texas and the Texas Department of Motor Vehicles has eliminated the requirement of a Texas State inspection on non-commercial vehicles as a result of House Bill 3297. The fee of $7.50 will continue to be collected under inspection replacement fee. Cameron County is not an emission county, therefore, county residents will not be subject to the Emissions Inspection Requirement or Fee.

For more information on this change, click here (pdf)

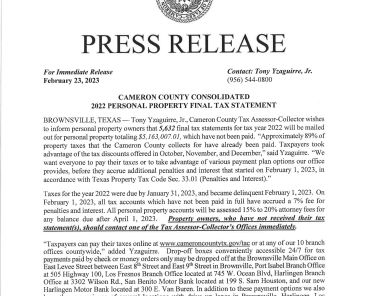

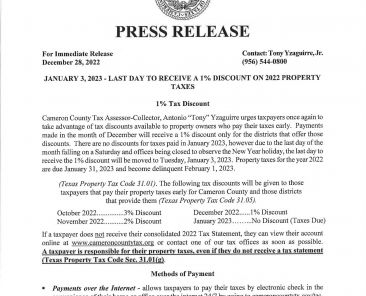

2024 property taxes must be paid in full on or before Tuesday, January 31, 2025 to avoid penalty and interest.

The delinquency date is Thursday, February 1, 2025 and a 7% penalty and interest will be added on property accounts with outstanding balances. Taxpayers who are not able to pay the full amount by January 31st, are encouraged to pay as much as possible but will be subject to penalty interest on the remaining balance.

Accounts with an Over-65 or Disabled Person Exemption that have elected the Quarter Pay option and have made their 1st payment on or before January 31st are not assessed penalty and interest.

Quarter Payment Installment Plan

Sec. 31.031 of the Property Tax Code allows individuals who are disabled/disabled veteran/ surviving spouse of a disabled veteran or at least 65 years of age and qualify for a homestead exemption, to choose an installment payment option on the property in which the homestead is claimed. Late payments will be charged penalty and interest per the Texas Property Tax Code.

Quarter Payment Installment Schedule:

– 1st installment due – January 31

– 2nd installment due – March 31

– 3rd installment due – May 31

– 4th and final installment due – July 31

The Tax Assessor-Collector is the constitutional office directed to assess and collect all ad valorem tax accounts as identified and valued by the Cameron Appraisal District. The Cameron County Tax Office also collects property taxes for all other taxing jurisdictions (school districts, cities and special districts) within Cameron County.

For the State of Texas, the office also collects fees for titles and registration of motor vehicles within the County. Our offices are dedicated ensuring your tax dollars are accurately and efficiently collected with the utmost integrity and honesty. Our goal is to exceed your expectations by ensuring the highest level of service possible using technology, tools and services to assist our taxpayers in transacting business with our office.

PROPERTY TAX PAYMENTS CAN BE MADE AT LONE STAR NATIONAL BANK LOCATIONS

Current Year Property Taxes can now be paid at Lone Star National Bank Locations in Cameron County. You must present your 2024 consolidated tax bill in order to make a payment at the Lone Star National Bank locations listed below.

- Paseo Banking Center, 101 America Drive, Brownsville, Tx 78520

- Brownsville Banking Center, 3300 N. Expressway 83, Brownsville, Tx 78520

- Boca Chica Banking Center, 2100 Boca Chica Blvd, Brownsville, TX 78520

- Harlingen Motor Bank, 1901 N. Ed Carey Drive Suite 100, Harlingen, TX 78550

- Port Isabel Motor Bank, 202 E. Queen Isabella Boulevard, Port Isabel, Tx 78578

- South Padre Island Banking Center, 601 Padre Boulevard, South Padre Island, TX 78597

- Brownsville Port Banking Center,3100 N. Indiana Ave., Brownsville, TX 78521

CONVENIENCE FEES

A service fee of $1.00 will be charged to pay a property tax bill using an Internet check in the amount of $5,000 or less, online check payments over $5,000.01 will be charged $3.00, *Credit and debit cards will incur a 3% convenience fee online and in person. We hope that you will find this website a useful tool. Please feel free to call us or visit any one of our 10 locations including our two new motor bank locations for personal service.

Property Tax Transparency in Texas

The budgets adopted by taxing units and the tax rates they set to fund those budgets play a significant role in determining the amount of taxes each property owner pays. In 2019, the Texas Legislature passed legislation to help Texans better understand tax rates in their home county. Access timely information about how local tax rate decisions affect your tax bill on your county’s Truth-in-Taxation website.

2023 property taxes are now delinquent. Taxpayers who are not able to pay the full amount due are encouraged to enter into a payment agreement.